The Complete Recipe for AI Finance Software: From Ingredients to a Ready-to-Serve Dish

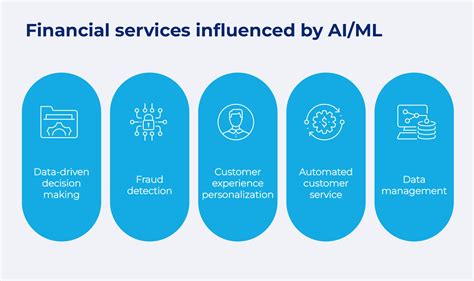

The world of finance is rapidly transforming, fueled by the advancements in Artificial Intelligence (AI). AI finance software is no longer a futuristic concept; it's a vital tool shaping the financial landscape. This article provides a comprehensive recipe for understanding, developing, and implementing successful AI finance software.

I. Gathering the Ingredients: Essential Components

Creating robust AI finance software requires a carefully selected blend of ingredients. These key components form the foundation of your application:

-

1. High-Quality Data: This is arguably the most crucial ingredient. Clean, accurate, and comprehensive financial data is the lifeblood of any successful AI model. This includes transactional data, market data, customer data, and any other relevant information. The quality of your data directly impacts the accuracy and reliability of your AI predictions. Data cleansing and preprocessing are critical steps.

-

2. The Right AI Algorithms: Selecting the appropriate algorithms depends on your specific needs. Common choices include:

- Machine Learning (ML): For tasks like fraud detection, risk assessment, and algorithmic trading. Specific ML models might include Random Forests, Support Vector Machines (SVMs), or Neural Networks.

- Deep Learning (DL): For more complex tasks such as sentiment analysis of market news or predicting complex financial time series. Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks are often used.

- Natural Language Processing (NLP): For analyzing news articles, financial reports, and social media sentiment to inform trading strategies or risk management.

-

3. Robust Infrastructure: Your software needs a powerful and scalable infrastructure to handle the volume of data and computations required. Cloud computing platforms (like AWS, Azure, or GCP) are often preferred for their flexibility and scalability.

-

4. Experienced Development Team: Building AI finance software requires expertise in AI, finance, software development, and data engineering. Assembling a skilled team is essential.

II. The Recipe: Steps to Develop AI Finance Software

The development process is iterative and involves several crucial steps:

-

1. Define Objectives: Clearly identify the specific financial problem you're trying to solve. What are your goals? Improved risk management? More efficient trading? Fraud detection? A clear objective guides the entire development process.

-

2. Data Acquisition and Preprocessing: Collect and prepare your data. This involves data cleansing, transformation, and feature engineering. Remember, garbage in, garbage out.

-

3. Model Selection and Training: Choose the most suitable AI algorithms based on your objective and data. Train the model using your prepared data. Experiment with different models and hyperparameters to optimize performance.

-

4. Model Evaluation and Validation: Assess the model's performance using appropriate metrics (accuracy, precision, recall, etc.). Validate the model on unseen data to ensure its generalizability.

-

5. Integration and Deployment: Integrate the AI model into your existing financial systems or create a new platform. Deploy the software in a secure and scalable environment.

-

6. Monitoring and Maintenance: Continuously monitor the model's performance and retrain it as needed to maintain accuracy and adapt to changing market conditions. AI models require ongoing maintenance to stay effective.

III. Serving the Dish: Ensuring Success

Building successful AI finance software requires more than just technical expertise. Consider these factors:

-

Regulatory Compliance: Ensure your software complies with all relevant financial regulations and data privacy laws.

-

Security: Implement robust security measures to protect sensitive financial data from unauthorized access and cyber threats.

-

Explainability and Transparency: It's crucial, especially in finance, to understand why the AI model makes certain predictions. Explainability helps build trust and ensures accountability.

-

User Experience: The software should be user-friendly and intuitive for financial professionals.

By following this recipe, combining the right ingredients, and meticulously following the steps, you can create powerful AI finance software that drives innovation and efficiency in the financial world. Remember that developing such software is an ongoing process, requiring continuous learning and adaptation.